Inheriting an IRA? Know the Distribution Rules

Please note that this is a very complicated area of financial planning and tax law and there are many exceptions and special situations to consider.

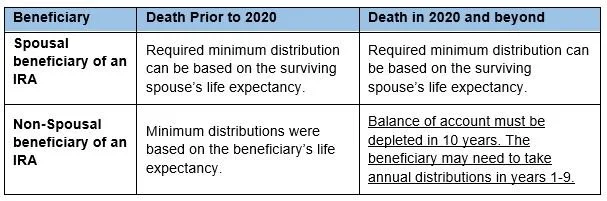

In 2020 Congress passed the SECURE Act which greatly impacted the distribution requirements for those who inherit IRAs—especially for non-spousal beneficiaries. Then in early 2022, the IRS issued proposed regulations that changed up what we thought we knew about the Secure Act and specifically, inherited IRAs.

Prior to the passage of the SECURE Act, non-spousal beneficiaries were allowed to essentially “drip” the required (taxable) IRA distributions over their lifetime. Doing so, allowed beneficiaries to have ongoing access to IRA funds, while continuing to defer/delay the overall tax impact.

Now, non-spousal beneficiaries are required to distribute the entire balance of an inherited IRA within 10 years! And depending on a lot of different complex rules, they will likely be required to take an annual distribution in years 1-9, with the entire account depleted in year 10.

That means a person inheriting a $1 million traditional IRA (not Roth IRAs), will be required to add $1 million (not including growth) of taxable income on top of their existing taxable income. This could present an enormous tax burden for those who fail to think strategically about the timing of taking these required distributions.

Strategies to Minimize the Tax Impact of Inherited IRA Distributions (for non-spousal beneficiaries)

Fortunately, those who inherit IRAs have some flexibility on the timing of thier required distributions. While there is a minimum distribution in the first 9 years, they can choose to take more than the minimum in any given year.

This distribution flexibility presents an opportunity when trying to minimize the tax impact. Here are a few questions to consider that could impact your decision:

Do you expect your taxable income to fluctuate any time over the next 10 years? Will you retire? Will you sell a business? Will there be any major changes? If so, you may consider taking higher distributions during those years in which you expect your income to be lower.

Will required minimum distributions from your own IRA commence in the next 10 years? What impact will these have on your taxable income? Are there options for minimizing the tax impact, through using qualified charitable distributions or other tax reduction strategies?

When will you begin receiving Social Security or other pension benefits? Would it be appropriate to delay receiving these benefits in order to minimize taxes on your required distributions?

What impact will your required distributions have on your Medicare premiums? Because the cost of Medicare premiums increase as your taxable income exceeds certain thresholds, it may be appropriate to accelerate inherited IRA distributions in order to avoid an increase in Medicare premiums.

The SECURE Act created some major changes in the area of required distributions from Inherited IRAs. Fortunately, with proper planning and a strategic focus, beneficiaries can develop a distribution plan that minimizes the tax impact.