Managing the Sequence of Returns Risk

Without the security of a stable paycheck, many new retirees may feel less than confident about relying on their investment portfolio to cover living expenses for the next 20 (or more) years.

Research has shown that the timing of one’s retirement can be important – especially as it relates to investment returns in the early years of retirement. Someone who retired just prior to the “Great Recession” could have experienced significantly larger portfolio “drawdowns” than someone who retired during a period of economic expansion and higher investment returns.

Consider the following:

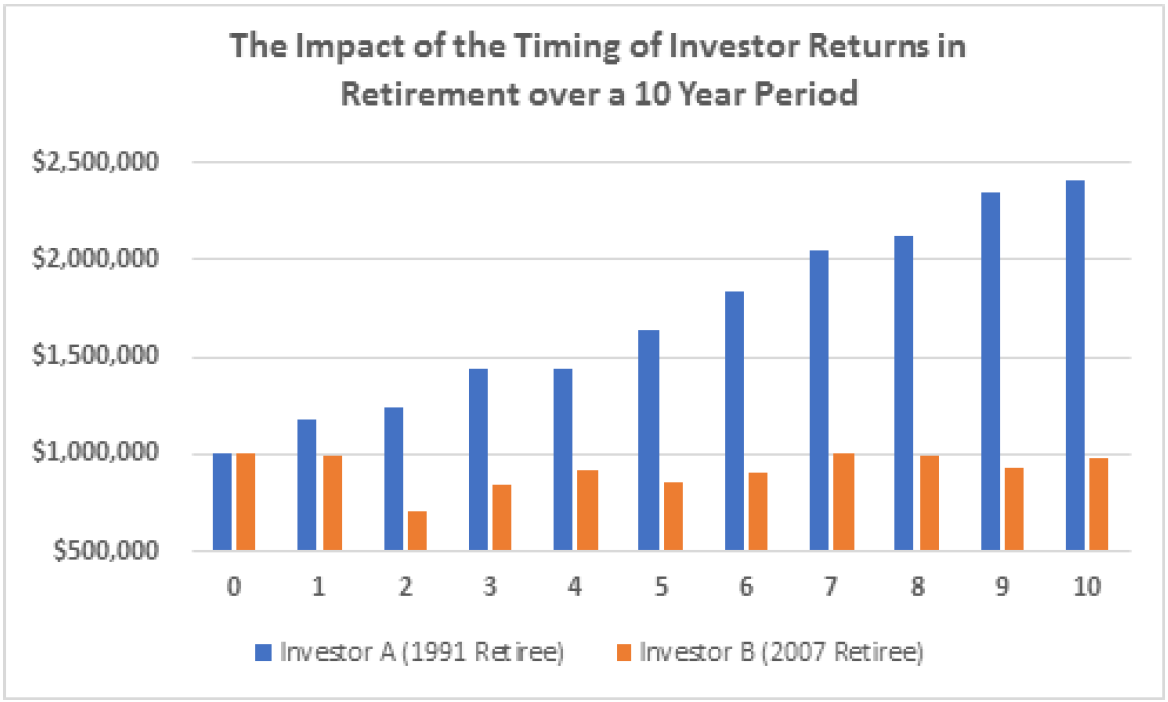

Investor A retires on January 1, 1991 with a portfolio valued at $1,000,000 and a $40,000 per year (4%) withdrawal need that is inflation adjusted by 3.5% each year.

Investor B retires on January 1, 2007 with a portfolio valued at $1,000,000 and a $40,000 per year (4%) withdrawal need that is inflation adjusted by 3.5% each year.

While both investors have identical portfolio allocations (60% stocks and 40% bonds) throughout the 10 year period, it is easy to see from the graph below that Investor A has a much better “retirement experience” than Investor B.

In fact, there is nearly a $1.5 million difference in portfolio values between the two investors at the end of the 10 year period! This difference in portfolio value will, no doubt, become more magnified with time as the withdrawal rate for Investor B is nearly 6% in year 11, but only about 2.5% for Investor A.

Managing the “Sequence of Returns” Risk

Although the order of returns in the financial markets are impossible to predict or control, there are several things that pre and new retirees can do to manage the impact of poor investment returns in the early years of retirement. Here are a few variables to consider:

Projecting Future Cash Flow Needs. In the early years of retirement, how much money will you need to withdraw from your portfolio? Should you set aside these expected withdrawals in a conservative “bucket” that would not be subject to stock market variability?

Optimizing Social Security and Pension Decisions. Is it best to delay or start your Social Security retirement or other pension benefit? What are the pros and cons of doing so? For pensions, should you choose the single life, or the joint and survivor alternative?

Making Tax-Efficient Portfolio Withdrawals. When making portfolio withdrawals, how much of each year’s disbursement should be withdrawn from qualified, non-qualified or Roth IRAs? This decision can change each year and be dependent on many factors including the level of itemized deductions and an individual’s current and future income tax bracket.

Leveraging Tax Bracket Management Opportunities. Given the progressive nature of tax brackets, is it possible to take advantage of an individual’s changing income level to control taxes? Strategically executing Roth conversions and “realizing” capital gains when investors are in the lower tax brackets are strategies that can have a significant impact.

Employing a Strategic Investment Approach. Making investment decisions within the context of a comprehensive retirement plan can significantly reduce the impact of the sequence of returns.

Generally, current and expected future cash flow needs and investor-specific circumstances are carefully considered when structuring the stock/bond mix of a portfolio. In addition, having a holistic understanding of each investor’s “moving parts” reinforces the confidence to make portfolio adjustments to take advantage of opportunities as they are available.

While retirees have no control over the sequence of investment returns during their retirement period, it is possible to increase the odds of a successful retirement through careful planning and effective financial and investment management. There are many changing variables specific to every individual and that can have a meaningful impact on the retirement experience.